Highlights for Homeowners Insurance

Whether your roof has recently suffered from storm damage, a fire, or any other unexpected act of nature, you’re probably wondering if your home insurance policy will cover the cost of a new roof. The good news is that most policies will help you out if your home has been affected by an event outside of your control. However, every homeowners’ insurance policy differs, so it’s important to understand the fine print of your policy and speak with your coverage provider to discuss any questions.

Table of Contents

Should I File a Roof Claim? – 5 Common Insurance Roof Replacement Questions

Last Updated: 6/10/2025 | Published: 1/16/2020

1. How much does it cost to replace a roof?

The average cost of roof replacement varies over time and location. However, once labor and materials become part of the picture, the average price of a new roof is about $15,000 in Middle Tennessee. Strong winds, hail damage, wind damage, heavy thunderstorms, extreme weather, and fallen trees are common causes of roof damage that may be covered by insurance. Still, coverage for these events may vary depending on your insurance policy.

Additionally, the type of roofing material or roofing materials used can significantly affect the durability of your roof and the likelihood of insurance covering repairs or replacement. Thankfully, home insurance companies typically cover some to all replacement costs for damaged roofs, depending on your policy, the extent of the damage, and the age of your roof.

2. Do I need to schedule a roof inspection?

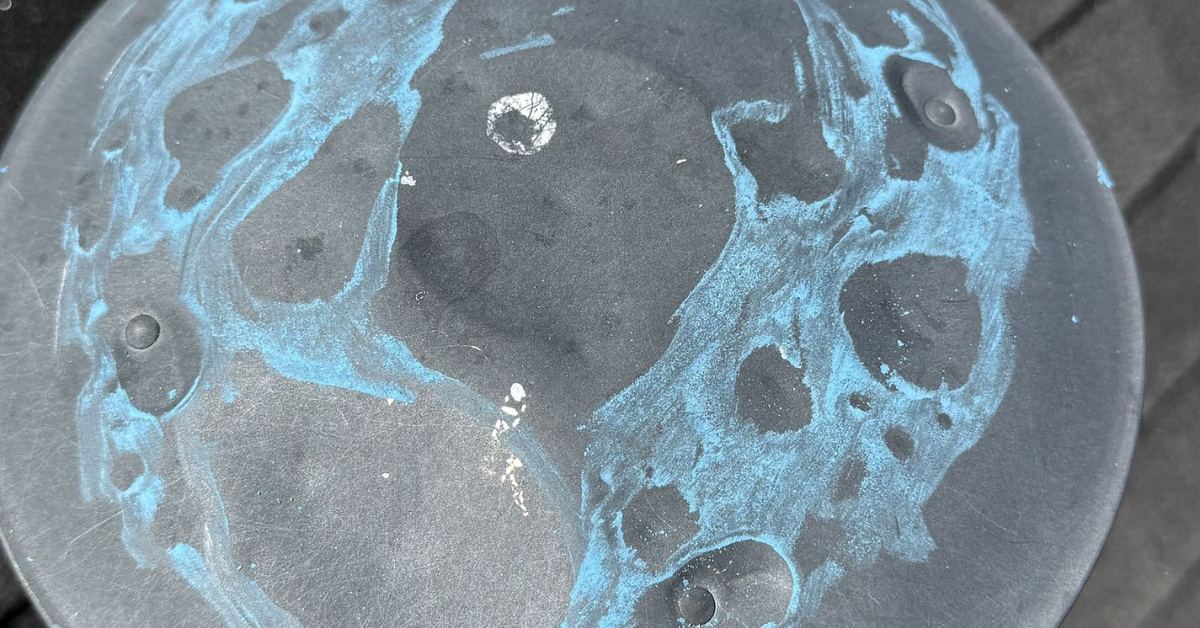

Yes, it is very important to schedule a roof inspection prior to filing an insurance claim. A free inspection is the first line of defense in identifying roof damage, and a detailed report from a professional inspection can help when filing a claim. Clear photos and documenting damage are essential steps before filing a claim, as they provide evidence for your insurance claims. If there is a dispute or denial, seeking a second opinion from another inspector or insurance adjuster may be helpful.

Our certified roof inspectors can determine whether your roof damage is claim-worthy, or if it just needs a small repair that can be applied to your deductible. We only advise filing an insurance claim if we feel confident that your insurance company will pay to replace the entire roof. You can do this for free by reaching out to our roofing contractors in Nashville, TN for a Signature 5 Point Inspection.

3. Will my homeowners insurance premium increase if I file a claim?

When filing a homeowners insurance claim for roof damage, the last thing you want to worry about is your insurance rate going up. Insurance premiums can be influenced by how many claims you have filed in the past, and maintaining your roof in good shape through regular maintenance can help avoid costly repairs and keep premiums lower. Many people fear they'll be required to pay more after filing a home insurance claim, but this isn't always the case. It is possible for premiums to be higher in areas with frequent severe weather, but simply filing for a roof replacement does not always affect your premium.

Also, keep in mind that future claims may be affected by your claims history and the condition of your roof, so it's important to keep your roof well-maintained. You should reach out to your home insurance company as soon as possible after experiencing roof damage. We also recommend taking pictures of the destruction and keeping any reports from your inspection.

4. Will my insurance cover my older roof?

This is a tricky question and the answer depends on your insurance policy. Roof age, older roofs, normal wear, and the roof's condition can significantly affect insurance coverage, and insurance policies vary depending on these factors. Technically, your roof claim can't be denied just because your roof is old – it either has storm damage or it doesn't. In fact, it can be advantageous to have an older roof because it can't properly be repaired, and the insurance company will have to pay for a full roof replacement. The caveat here is that it depends on your policy.

There is a difference between actual cost value (ACV), actual cost, and depreciated value in insurance payouts for older roofs. Replacement Cost Value vs. Actual Cash Value policies differ: if you have a Replacement Cost Value policy, your home insurance company will owe for a full replacement. However, if you have an Actual Cash Value policy, they owe for a full roof replacement but will depreciate the amount that you get paid based on the roof's depreciated value. Your insurance provider and insurance agent can help clarify policy details for older roofs. Informed decisions about filing a claim should be based on a thorough understanding of your policy and the results of an adjuster's inspection.

5. Do I need to install a tarp on my damaged roof?

If your roof has damages, you should consider tarping it for several reasons. Covering roof damage promptly with a tarp can prevent additional damage and costly repairs, and an insurance adjuster or repair services may recommend filing a claim if the damage is severe. First, you want to protect you and your household. Also, your home insurance company will expect you to prevent further damage to the interior and exterior of your home.

Damaged shingles should be repaired quickly to avoid further damage, and regular maintenance is important for keeping your roof in good shape. Not doing so is risky, especially if severe weather or heavy rain is in the forecast. Without taking extra precautions to protect your roof, it's possible that your home insurance company may not help cover the cost of a new one. For more tips on handling insurance claims and roof repairs, consult your insurance provider or insurance agent.

The Importance of Documentation in Your Roof Replacement Claim

When it comes to filing a roof replacement claim with your insurance company, proper documentation can make all the difference in achieving a successful claim. Start by taking clear, date-stamped photos and videos of your roof's condition before and after any damage occurs. Even minor problems should be documented, as they can significantly impact the claims process and help demonstrate the full extent of roof damage.

A thorough inspection by a professional roofing contractor is also essential. Not only can a reputable roofing contractor provide a detailed inspection report, but this documentation serves as valuable proof for your insurance company, supporting your claim and helping to streamline the claims process. Be sure to keep copies of all inspection reports, repair estimates, and any correspondence with your insurance company—including emails, phone calls, and letters.

By maintaining organized records and thorough documentation, you'll be better prepared to provide proof of damage, avoid misunderstandings, and ensure your roof replacement claim is processed efficiently. This proactive approach can significantly increase your chances of a successful claim and help you get the insurance coverage you deserve for your roof.

When to Consider Working with a Public Adjuster

If you find yourself struggling with your insurance claim or feel that your insurance company isn't offering a fair settlement for your roof replacement, it may be time to consider working with a public adjuster. A public adjuster is an independent professional who specializes in helping homeowners navigate the insurance claim process. They can review your insurance policy, assess the roof damage, and negotiate directly with your insurance company to help you secure the best possible outcome.

Public adjusters are especially helpful if your claim is complex, if you're unsure about the details of your insurance policy, or if you're facing challenges during the claims process. They can clarify your insurance coverage, ensure all necessary documentation is submitted, and advocate on your behalf to maximize your settlement. It's worth noting that public adjusters typically work on a contingency basis, meaning they only get paid if you receive a settlement. For this reason, it's important to choose a reputable and experienced public adjuster to handle your claim.

By enlisting the help of a public adjuster, you can feel confident that your roof replacement claim is being managed professionally, giving you peace of mind and helping you get the insurance benefits you're entitled to under your policy.

Get in Touch With Us for A Free Roof Inspection

If your roof has recently undergone damage, Five Points Roofing can help. Make sure to reach out to us today to schedule your free roof inspection. If you need a new roof, our team of HAAG certified roofers can install a beautiful, new shingle or metal roof for your home. Contact us to learn more about your roof replacement options!