Highlights for Roofing Insurance Terms

Replacing a roof is a significant investment, and navigating the insurance process can be confusing for homeowners in Middle Tennessee. Understanding insurance terms like Actual Cash Value (ACV), Replacement Cost Value (RCV), and Recoverable Depreciation can help homeowners make informed decisions, ensure their property is properly insured, and ensure they have adequate coverage. This guide breaks down these essential terms, outlines the insurance claim process, and offers expert tips to help Franklin, Nashville, and Brentwood residents protect their homes and pocketbooks.

Table of Contents

Why Understanding Roofing Insurance Terms Matters

Every year, homeowners file thousands of roof insurance claims across Tennessee. Yet many homeowners enter this process unprepared, leading to confusion and financial setbacks. Understanding insurance terminology equips you to recognize your policy's strengths and limitations. For example, knowing the difference between actual cash value and replacement cost value can mean the difference between a full replacement and a partial reimbursement.

In some cases, homeowners have received less than 50% of their roof's full cost because they misunderstood their home insurance policy. Not understanding your policy increases the risk of claim denial or reduced payouts. Moreover, being familiar with concepts like deductible and coverage limits, and indemnification helps ensure you're not blindsided by hidden costs.

If a claim is denied due to improper understanding or poor documentation, you might end up paying the entire cost of roof repairs. By learning these terms upfront, you safeguard your investment and gain the ability to ask informed questions when dealing with your insurance adjuster or a reputable roofing company.

Key Insurance Terms to Know

Actual Cash Value (ACV)

Actual Cash Value (ACV) refers to your roof's depreciated value at the time of loss. Insurance companies determine this by subtracting depreciation from the replacement cost. For example, a 15-year-old roof initially valued at $20,000 might have depreciated 50%, resulting in a $10,000 payout. This matters most when your roof is older, as many insurance policies don't pay the full amount for an older roof. Insurance companies often consider older roofs a higher risk and may only offer actual cash value coverage instead of full replacement cost.

The roof's age is a key factor in determining the amount paid out under an ACV policy, as older roofs will have more depreciation applied. Understanding this difference can protect you from surprises during the claims process. Policies that rely on ACV tend to pay less for repairs and require homeowners to cover the gap themselves, especially in cases involving accidental damage or normal wear.

Replacement Cost Value (RCV)

RCV is what your insurer pays for a new roof using materials of a similar kind and quality. There's no deduction for wear and tear, which means you'll get the full replacement value, assuming your home insurance policy includes this feature. If hail damage or a fallen tree damages your roof, RCV helps ensure you're not left covering thousands out of pocket. Homeowners in Brentwood have seen RCV policies cover full replacement after major storms. Choosing contractors who know how to document damage properly and work with your insurer ensures better results and full reimbursement.

Recoverable Depreciation

Recoverable depreciation is the portion of your claim withheld until the replacement is complete. For example, if your new roof costs $18,000, and the insurance company initially pays $12,000 (ACV), you can recover the remaining $6,000 once the job is done and you submit proof. This concept is crucial because many homeowners never reclaim the full amount due to paperwork issues. A well-maintained roof and accurate documentation play a key role in maximizing this reimbursement.

Deductible

Your deductible is what you pay before insurance coverage kicks in. Most Middle Tennessee homeowners have deductibles between $500 and $2,500. Some policies use percentage-based deductibles, which can be much higher for claims involving wind or hail. For instance, a roof leak from storm damage might only be partially covered if your deductible is too high or unclear. Reviewing your deductible and coverage limits with your contractor and insurance company helps determine the financial impact of any claim.

Premium

Your premium is the cost of keeping your home insured. Filing a roof insurance claim may increase this cost, particularly if you've filed multiple home insurance claims in recent years. Homeowners who file small claims frequently may see their premiums rise significantly. It's important to weigh the potential benefits of filing against possible premium hikes. Some homeowners decide to pay for minor roof repairs themselves to avoid long-term premium increases.

Named Perils vs. Open Perils

Homeowners insurance policies fall into two categories: named perils and open perils. Named perils cover specific events like fire, falling objects, windstorm, or hail. Open perils cover everything except what is explicitly excluded. If your policy only covers certain perils, you might not be protected if your roof's damage isn't specifically listed. A damaged roof from wind or water damage might only be covered under an open peril policy. Always verify your policy details and what your insurer is obligated to cover.

Matching Law (Tennessee-specific)

Tennessee's Matching Law requires your home insurance company to ensure that the replaced roofing materials match the undamaged portions. For example, if your roof has missing or damaged shingles and those shingles are no longer available, your insurer may be required to pay for a full replacement. Knowing this law protects homeowners from patchwork repairs that lower a property's value. Contractors familiar with Tennessee regulations will make sure this right is respected during the claims process.

Act of God

An "Act of God" includes events like a storm, wind, or hail damage that were beyond anyone's control. These are typically covered by homeowners' insurance, but a lack of maintenance or an older roof can give your insurer grounds to deny the claim. If your home isn't well-maintained, insurance companies might argue that your damaged roof resulted from neglect rather than a covered peril. Keeping up with maintenance and getting regular inspections strengthens your ability to prove the damage was caused by a natural event.

Indemnification

Indemnification ensures your home is restored to its pre-loss condition. This means the insurer pays for materials and labor equivalent in quality and type to what was originally there. For example, if you had high-end shingles and suffered damage from a fire or a fallen tree, your insurance policy should cover the cost to replace them with something similar. Having a written estimate from your contractor that details the full cost of repair supports your claim for proper indemnification.

80% Co-Insurance Rule

This rule means your home must be insured for at least 80% of its replacement value to receive full claim payouts. If you're underinsured, your payout could be significantly reduced. For instance, insuring your home for $200,000 when its replacement cost is $300,000 could limit your coverage. Many homeowners don't realize this until it's too late. Keeping your homeowners policy updated helps ensure you're eligible for the full amount in case of significant roof damage.

The Insurance Claim Process from Start to Finish

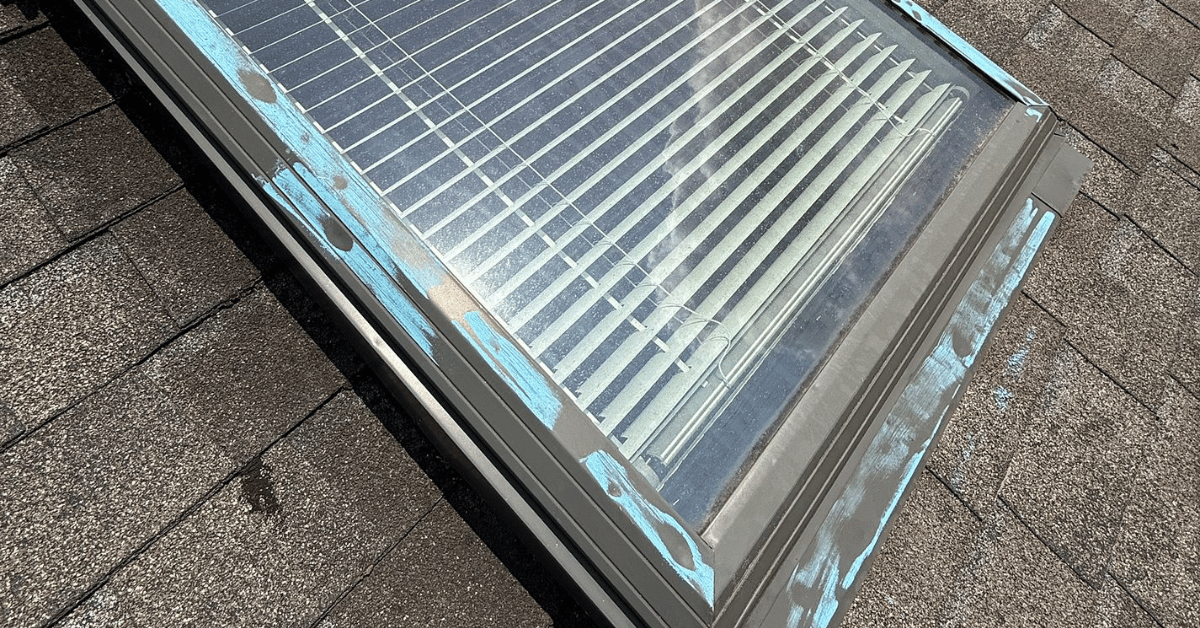

Pre-Claim Inspection

Start with a roof inspection from a licensed roofing company before contacting your insurer. Hiring a reputable roofing contractor is crucial to ensure a thorough inspection and proper documentation for your claim. This determines whether your damaged roof qualifies for coverage and helps document necessary evidence. In one homeowner's case, inspectors found moisture damage hidden beneath damaged shingles was only uncovered by thermal imaging—something that helped the homeowner access full insurance coverage. Hire contractors who know how to present this evidence.

Filing the Claim

Once you've confirmed roof damage, contact your insurance company. Most allow online or mobile claims. Include detailed documentation, and keep track of all communication. Filing within policy deadlines is crucial. The sooner you file, the better chance your home insurance company can act quickly and prevent further deterioration, such as from a growing roof leak.

Adjuster Walkthrough

An insurance adjuster will visit to inspect the roof. Always have your contractor present. Their expertise ensures that no signs of wear and tear, accidental damage, or missing shingles are overlooked. This step is where many homeowners lose out by trusting the insurance adjuster alone without third-party verification.

Reviewing the Estimate

Compare the adjuster's estimate with your contractor's written estimate. Confirm that all materials, labor, and necessary code upgrades are included. If items are missing, your claim payout could be far below what you need for a proper roof replacement. Work with experienced contractors who understand insurance claims.

Choosing Materials

After claim approval, select roofing materials within your policy's coverage. Whether you are replacing damaged shingles or upgrading to a metal roof, your choice must comply with what's allowed by your home insurance policy. Use this step to ensure the final result is both durable and attractive.

Completing the Replacement

Your contractor will complete the roof replacement and submit all documentation. Keep photos, invoices, and inspection records to streamline your final payout. This is how you recover the full amount, including any recoverable depreciation held back by the insurer.

Common Questions from Homeowners

Does homeowners' insurance cover roof replacement in Middle Tennessee?

Yes, homeowners' insurance covers a roof replacement if it's caused by a covered peril like hail, wind, or fire, not normal wear or lack of maintenance. Whether insurance covers roof damage will depend on the cause of the damage and the specific terms of your policy.

What's a typical deductible for a roof claim?

Anywhere from $500 to a few thousand dollars, depending on your homeowners' insurance policy.

Can I choose who does my roof repairs?

Absolutely. Always hire a reputable roofing company that knows how to work with your insurer. Roof repair is different from roof replacement—repair addresses specific areas of damage, while replacement involves installing a new roof. Proper repair and maintenance of roofs are important for maintaining insurance coverage.

Pro Tips for Filing a Successful Roof Claim

- Take clear before-and-after photos

- Keep all repair receipts and documents

- Know your deductible and coverage limits

- Don't delay in reporting a damaged roof

- Choose contractors with insurance claim experience

Why Homeowners Trust Five Points Roofing

We're not just a roofing company—we're your neighbors. We've helped hundreds of Middle Tennessee homeowners navigate home insurance claims after hail, wind, and storm damage, and we also have experience assisting clients with other types of insurance claims, such as auto insurance.

With expert inspectors and a commitment to honesty and quality, we handle the insurance process so you can focus on protecting your home. Our team ensures you receive the full cost of repairs or a new roof. We're here to help, from your first inspection to your final walkthrough.

Know Your Terms, Protect Your Roof

Understanding the fine print in your insurance policy is more than a good idea—it's a necessity when your roof is on the line. From determining actual cash value to confirming what types of damage are covered, knowing these terms gives you the power to make smart decisions. Whether your roof was damaged by hail, a fallen tree, or normal wear, make sure you're ready with the right information. Don't wait for a storm to find out what's in your policy. Get a roof inspection today and partner with a company that knows how to protect what matters most.